When interest rates climb, homeowners and buyers alike often feel pressure on their monthly budgets. Fortunately, there are strategies that can help you save money and manage your mortgage more effectively even in a rising rate environment. By making thoughtful adjustments and using available tools, you can still work toward long term financial security.

When interest rates climb, homeowners and buyers alike often feel pressure on their monthly budgets. Fortunately, there are strategies that can help you save money and manage your mortgage more effectively even in a rising rate environment. By making thoughtful adjustments and using available tools, you can still work toward long term financial security.

Make Extra Payments Toward Principal

One of the simplest ways to reduce the total cost of your mortgage is by making extra payments directly toward your principal balance. Even adding a small amount each month, or making one additional full payment per year, can cut your loan and significantly reduce the interest you pay over time.

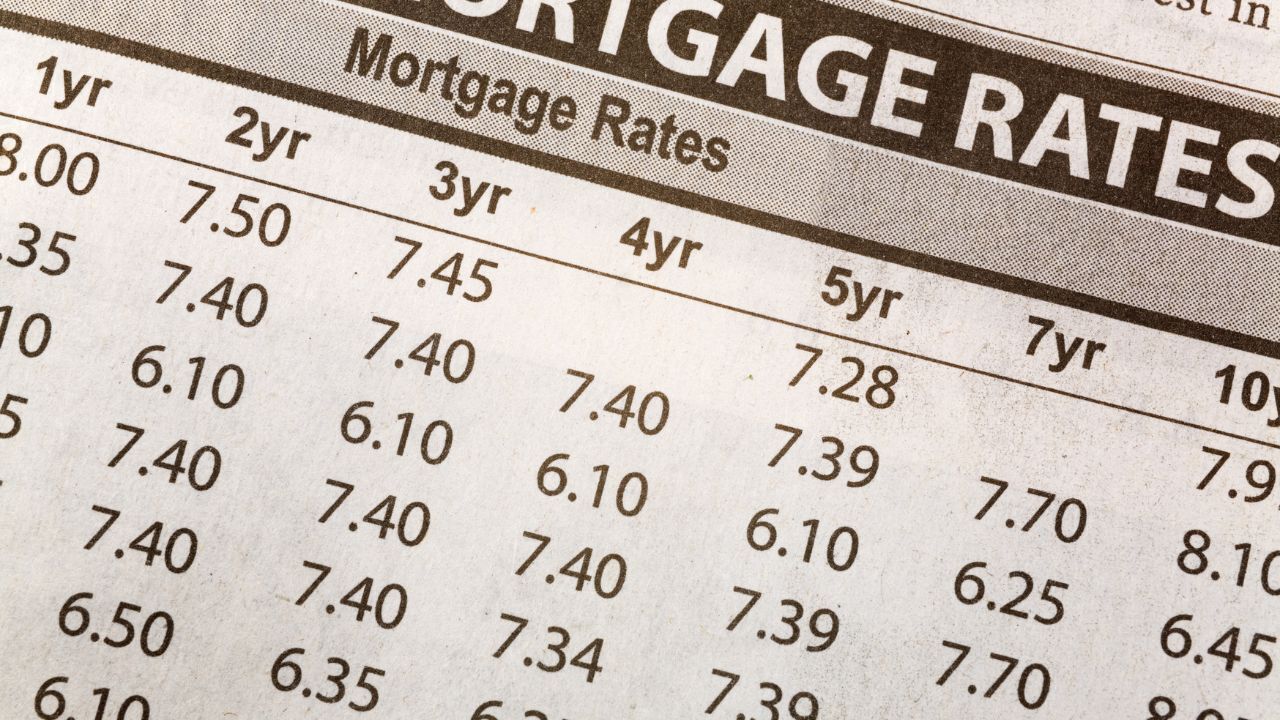

Consider Refinancing Options

If you already own a home, refinancing it to a shorter-term mortgage could help. While monthly payments may be higher, shorter-term loans often come with lower interest rates, which can save you thousands of dollars in the long run. It is important to run the numbers carefully to ensure the savings outweigh any closing costs.

Evaluate Mortgage Points

For both new buyers and current homeowners, paying mortgage points upfront can be a worthwhile strategy. This option allows you to buy down your interest rate, creating lower monthly payments and long-term savings. If you plan to stay in the home for many years, this can be a strong financial move.

Strengthen Your Credit Profile

Your credit score plays a major role in the rate you are offered. Taking steps such as paying down revolving debt, correcting errors on your credit report, and avoiding new credit inquiries before applying for a mortgage can put you in a stronger position to qualify for a better rate.

Leverage Extra Income Wisely

Unexpected financial boosts such as tax refunds, bonuses, or other windfalls can be powerful tools when applied directly to your mortgage balance. Rather than spending these funds elsewhere, applying them to your loan can accelerate your progress toward becoming debt free.

Review and Adjust Your Budget

In a rising rate environment, careful budgeting becomes even more important. Look for areas in your monthly expenses where you can adjust and reallocate savings toward your mortgage. This proactive approach helps offset the effect of higher rates and keeps your financial goals on track.

Rising interest rates do not have to derail your homeownership journey. By using these strategies, you can minimize the impact, stay ahead financially, and continue building equity in your home.