Your mortgage statement is an important document that provides detailed information about your home loan. Understanding it can help you manage your mortgage more effectively, identify potential issues early, and ensure you’re on track with your payments. Here is a list to help guide you when reading your mortgage statement, what to look for, and how to verify its accuracy.

Your mortgage statement is an important document that provides detailed information about your home loan. Understanding it can help you manage your mortgage more effectively, identify potential issues early, and ensure you’re on track with your payments. Here is a list to help guide you when reading your mortgage statement, what to look for, and how to verify its accuracy.

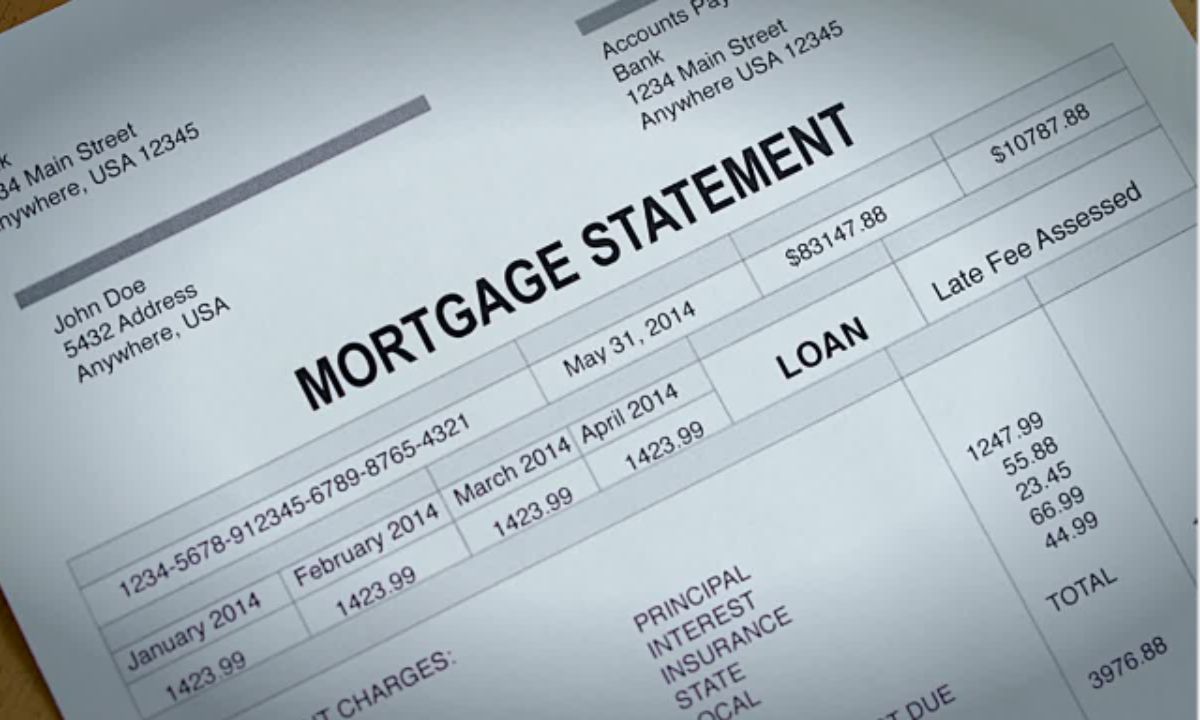

Key Components of a Mortgage Statement

- Account Information

- Loan Number: A unique identifier for your mortgage.

- Property Address: The address of the property financed by the mortgage.

- Payment Information

- Current Payment Due: The amount you need to pay by the due date.

- Due Date: The date by which the payment must be made to avoid late fees.

- Previous Balance: The amount you owe from the previous statement.

- Payments Received: Payments made since the last statement.

- Escrow Account

- Escrow Balance: The amount held in escrow for property taxes and insurance.

- Escrow Payments: The portion of your monthly payment that goes into the escrow account.

- Transaction Activity

- Payments: Detailed list of payments made, including principal, interest, and escrow.

- Charges: Any additional fees or charges applied to your account.

- Loan Information

- Principal Balance: The remaining balance on your loan.

- Interest Rate: The current interest rate on your mortgage.

- Loan Term: The length of your loan in years.

- Contact Information

- Contact details for customer service, in case you have questions or concerns about your statement.

How to Read and Understand Your Mortgage Statement

- Verify Personal and Loan Information

- Ensure that your loan number, property address, and personal details are correct. Any discrepancies should be reported immediately to your mortgage servicer.

- Check Payment Details

- Compare the “Current Payment Due” with what you expect to pay. Ensure that the due date is noted and plan your payment accordingly to avoid late fees.

- Review the “Previous Balance” and “Payments Received” sections to ensure that all your payments have been accurately credited.

- Review Escrow Account Activity

- Look at the escrow balance and payments to ensure that your taxes and insurance are being correctly funded. If there are significant changes, contact your servicer to understand why.

- Analyze Transaction Activity

- Ensure that all payments, fees, and charges listed are accurate. If you see any unfamiliar fees or charges, contact your mortgage servicer for clarification.

- Understand Your Loan Details

- Keep track of your principal balance to see how much you owe over time. Knowing your interest rate and loan term is also essential for planning and managing your finances.

Ensuring the Accuracy of Your Mortgage Statement

- Keep Records

- Maintain a record of all your mortgage payments, including bank statements, payment receipts, and previous mortgage statements. This helps in cross-referencing and verifying the accuracy of your current statement.

- Compare Statements

- Regularly compare your current mortgage statement with previous ones to identify any discrepancies or unusual changes.

- Monitor Escrow Account

- Keep an eye on your escrow account to ensure that payments for property taxes and insurance are correctly allocated. Request an annual escrow analysis from your mortgage servicer.

- Contact Your Servicer

- If you notice any errors or discrepancies, contact your mortgage servicer immediately. Keep a record of all communications, including dates, names of representatives you spoke with, and the nature of the discussions.

- Seek Professional Help

- If you are unsure about any aspect of your mortgage statement or encounter issues with your servicer, consider consulting with a financial advisor or a housing counselor.

Reading and understanding your mortgage statement is essential for effective mortgage management. Regularly reviewing your mortgage statement and maintaining accurate records will help you stay on top of your mortgage and achieve your homeownership goals smoothly. Feel free to leave any questions or comments below and we will be happy to assist you!

When it comes to building wealth and securing your financial future, a mortgage can be a powerful tool. While taking on debt might seem counterintuitive to achieving financial freedom, a mortgage, when managed wisely, can provide numerous benefits. Here’s how leveraging a mortgage can pave the way to a stronger financial future.

When it comes to building wealth and securing your financial future, a mortgage can be a powerful tool. While taking on debt might seem counterintuitive to achieving financial freedom, a mortgage, when managed wisely, can provide numerous benefits. Here’s how leveraging a mortgage can pave the way to a stronger financial future.