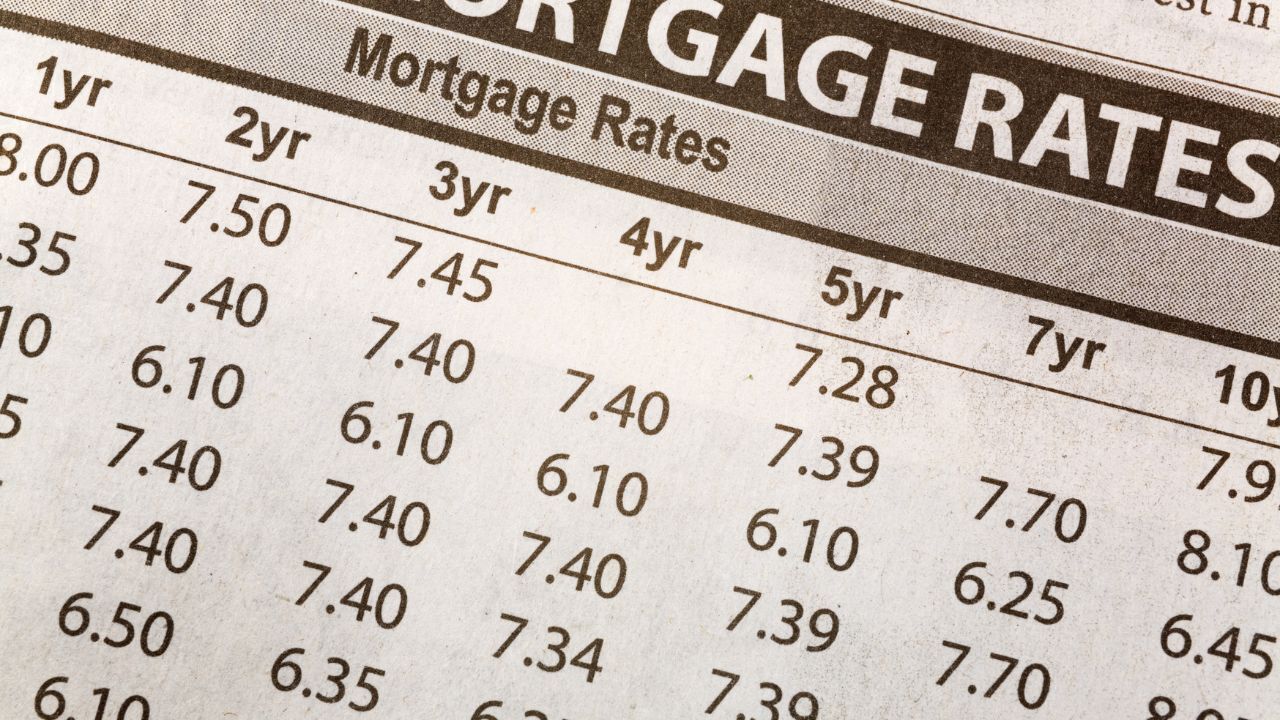

Understanding the Impact of Rising Rates

Mortgage rates play a major role in how much house you can afford. Even a small increase can raise monthly payments and affect how much you qualify for. For example, the same loan amount at a higher rate could cost hundreds of dollars more each month. This is why buyers often feel pressure to act quickly when rates begin to climb.

However, it is important to remember that interest rates are only one piece of the puzzle. Homeownership provides long-term value, stability, and the opportunity to build equity. Instead of focusing only on the rate, look at the bigger picture of your financial situation and goals.

Strategies to Save

There are several ways to reduce the impact of higher mortgage rates. One option is to improve your credit score before applying. A stronger credit profile can help you qualify for better terms, even in a rising rate environment. Paying down debt and making all payments on time are simple but effective steps.

Another strategy is to increase your down payment. The more you put down, the less you borrow, which lowers your monthly payment and overall interest costs. Even a small increase in your down payment can make a noticeable difference.

You can also explore different loan programs. Some buyers may benefit from adjustable rate mortgages, which offer a lower initial rate for a set period of time. While not right for everyone, this option can provide flexibility if you plan to move or refinance within a few years.

Finally, consider buying points to lower your interest rate. This means paying an upfront cost at closing in exchange for a reduced rate. While it requires extra cash at the beginning, it can lead to long-term savings if you plan to stay in the home.

Planning for the Future

The most important step is to work with a trusted mortgage professional who can help you compare options and design a strategy that fits your situation. Every buyer is different, and the right approach depends on your income, savings, goals, and timeline.

Even in a rising rate environment, there are always opportunities for smart planning. By focusing on what you can control, such as credit, down payment, and loan structure, you can make confident decisions that support your dream of homeownership.

With the right preparation, buying a home is possible in any market, and you can find ways to save despite higher rates.