If you’ve been managing your finances responsibly but don’t have a traditional credit score, you may be wondering whether homeownership is still within reach. The good news? It is! While most mortgage lenders rely on credit scores to assess your creditworthiness, alternative credit history—like rent payments, utility bills, and other recurring expenses—can help you qualify for a mortgage.

If you’ve been managing your finances responsibly but don’t have a traditional credit score, you may be wondering whether homeownership is still within reach. The good news? It is! While most mortgage lenders rely on credit scores to assess your creditworthiness, alternative credit history—like rent payments, utility bills, and other recurring expenses—can help you qualify for a mortgage.

What Is Alternative Credit History?

Alternative credit history consists of financial records that demonstrate your ability to manage debt and make payments on time, even if you don’t have a credit card or traditional loans. Some examples include:

- Rent payments – A history of on-time rent payments can be a strong indicator of financial responsibility.

- Utility bills – Consistent payments for electricity, water, gas, and even phone bills can showcase your reliability.

- Insurance premiums – Paying for car, health, or renter’s insurance on time adds to your credibility.

- Streaming or subscription services – Some lenders may even consider consistent payments for services like Netflix or a gym membership.

How Do Mortgage Lenders Use Alternative Credit?

Some lenders, especially those offering FHA, VA, and USDA loans, accept alternative credit data in place of a credit score. Instead of pulling a standard credit report, they may request documentation proving your payment history, such as:

- Canceled checks

- Bank statements showing recurring payments

- Letters from landlords or service providers confirming on-time payments

Additionally, Fannie Mae and Freddie Mac now allow rent payments to be factored into credit evaluations when applying for conventional loans, making it easier for first-time homebuyers to qualify.

What Are the Requirements?

While each lender may have different criteria, here are some general guidelines to keep in mind:

- A strong rental history – Typically, lenders want to see at least 12 months of consistent, on-time rent payments.

- Three or more alternative credit sources – Having multiple payment histories helps build a well-rounded financial profile.

- Stable income and employment – Lenders still evaluate your ability to afford a mortgage based on your earnings and job history.

- Low debt-to-income (DTI) ratio – Keeping your total monthly debts (including the future mortgage payment) below 43% of your income improves your chances of approval.

Which Mortgage Programs Accept Alternative Credit?

If you don’t have a traditional credit score, consider these mortgage options:

- FHA Loans – Backed by the Federal Housing Administration, FHA loans are ideal for borrowers with limited credit history.

- VA Loans – If you’re a veteran or active-duty military member, VA loans offer flexible credit requirements.

- USDA Loans – Designed for rural homebuyers, these loans allow alternative credit history for qualification.

- Manual Underwriting on Conventional Loans – Some lenders offer manually underwritten loans, meaning a person (rather than an automated system) reviews your finances.

Tips for a Successful Mortgage Application

- Keep records of payments – Save bank statements, receipts, and letters from service providers.

- Use a rent-reporting service – Some companies, like RentTrack or Experian Boost, can help report your rent payments to credit bureaus.

- Work with a knowledgeable mortgage lender – Not all lenders accept alternative credit, so finding one who specializes in this process is key.

Yes, you can get a mortgage without a credit score! By leveraging alternative credit history, demonstrating financial responsibility, and choosing the right loan program, you can achieve homeownership—even without a traditional credit report. If you’re unsure where to start, connect with a mortgage professional who can guide you through the process and help make your dream of owning a home a reality.

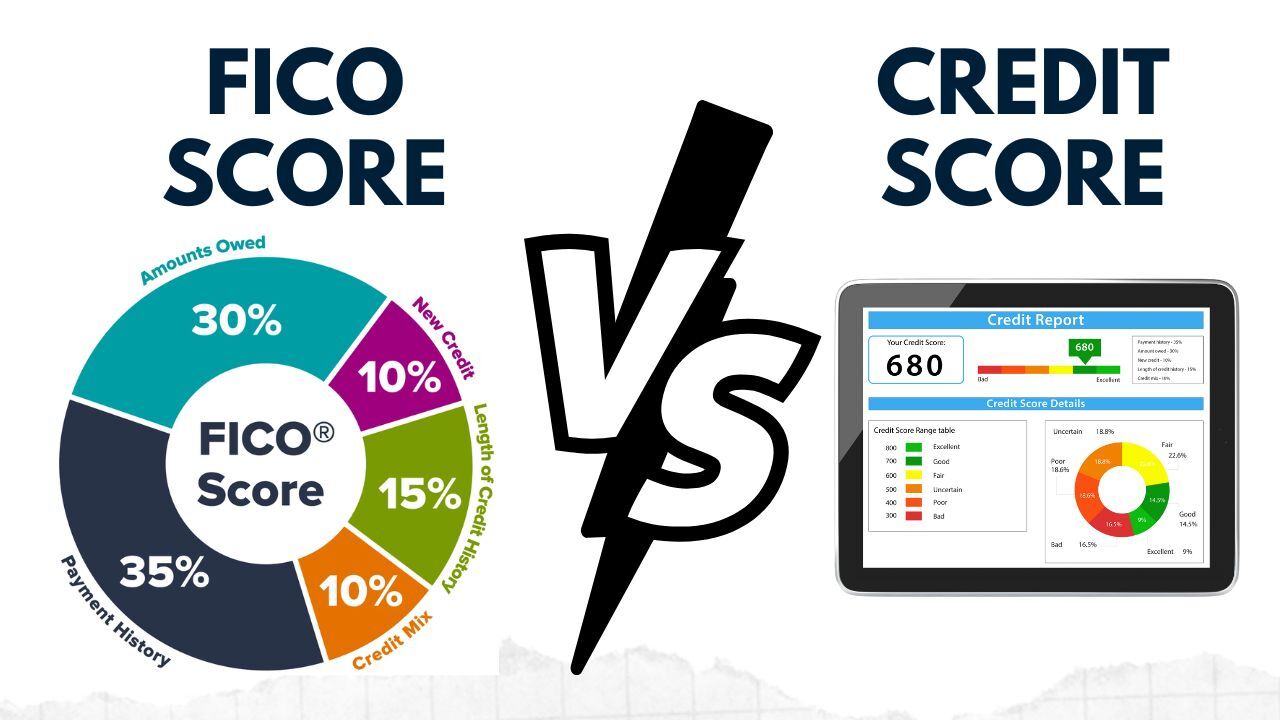

When applying for a mortgage, your creditworthiness plays a significant role in determining your loan approval and interest rates. Two commonly referenced terms are FICO score and credit score, which are often used interchangeably but have distinct differences.

When applying for a mortgage, your creditworthiness plays a significant role in determining your loan approval and interest rates. Two commonly referenced terms are FICO score and credit score, which are often used interchangeably but have distinct differences.